Market news

Market news

05.11.2024 | Impermanent loss can catch liquidity providers by surprise. So, what does it mean, exactly?

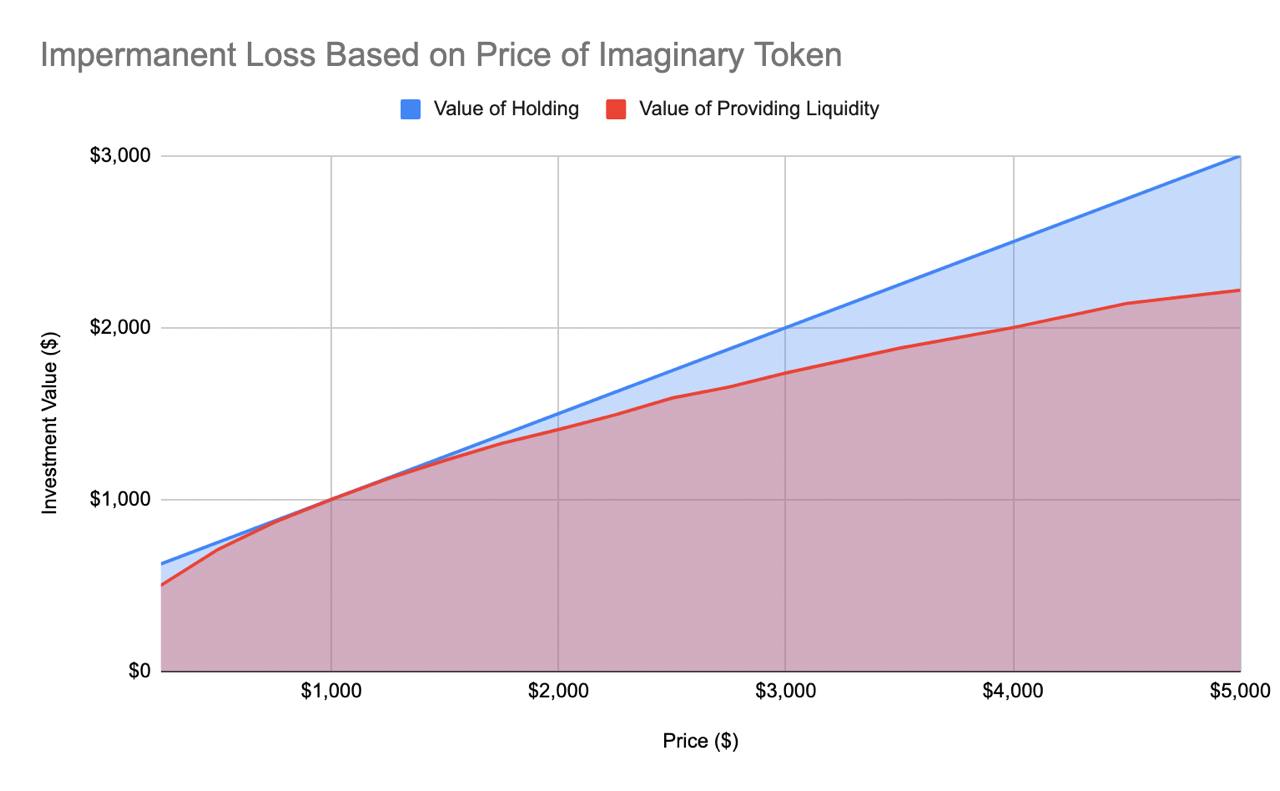

It's the potential downside providers face when their returns from contributing to a pool are less than what they would have earned by simply holding the assets.

Here's a simple example:

You contribute $1,000 each in ETH and USDT to a liquidity pool. If ETH's price goes up, the pool self-adjusts, selling some ETH for more USDT to maintain balance. When you eventually withdraw, you’ll have more USDT and less ETH than what you started with.

If ETH’s price had surged, you might have been better off just holding it, resulting in an impermanent loss. This loss is called “impermanent” because it could disappear if the prices return to their initial state.

Stay smart and always assess the risks before diving into liquidity pools!

Here's a simple example:

You contribute $1,000 each in ETH and USDT to a liquidity pool. If ETH's price goes up, the pool self-adjusts, selling some ETH for more USDT to maintain balance. When you eventually withdraw, you’ll have more USDT and less ETH than what you started with.

If ETH’s price had surged, you might have been better off just holding it, resulting in an impermanent loss. This loss is called “impermanent” because it could disappear if the prices return to their initial state.

Stay smart and always assess the risks before diving into liquidity pools!