Sterling legal

Sterling legal

Legal Opinion No. 10-10 / 595 (24)

To whom it may concern,

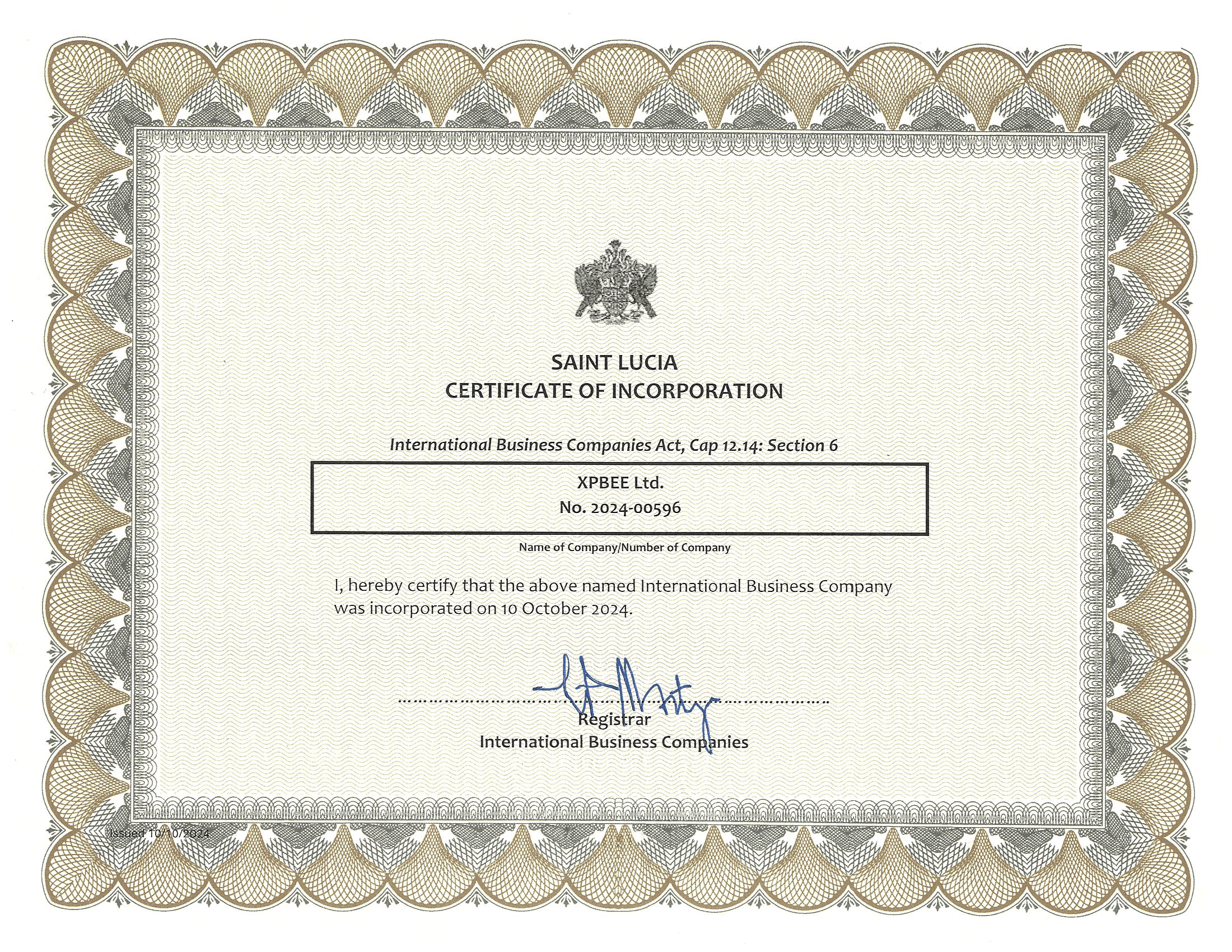

This legal opinion (hereinafter referred to as the "Conclusion") has been prepared for the payment systems providers, banks and other jurisdictions as well as for any person who may be interested in the following information, at the request of XPBEE Ltd. (reg.nr:2024-00596), incorporated in Saint Lucia (hereinafter referred to as the "Broker"). We have been instructed to advise on the possibility of the Broker carrying on the services in the international forex (hereinafter referred to as the "FX”) and contract for differences (hereinafter referred to as the "CFDs”) market to retail and corporate clients (hereinafter referred to as the "Services") in accordance with the laws of Saint Lucia.

During the preparation of this Opinion, we have done a comprehensive analysis of the information and documents provided by the Broker, his working mechanism, as well as the current legislation applicable in Saint Lucia. We have prepared answers to the following questions set by the Broker:

1. How is the sphere of the Financial Services regulated on the territory of Saint Lucia?

2. Does Broker’s activity require a license in accordance with the laws of Saint Lucia?

This legal opinion (hereinafter referred to as the "Conclusion") has been prepared for the payment systems providers, banks and other jurisdictions as well as for any person who may be interested in the following information, at the request of XPBEE Ltd. (reg.nr:2024-00596), incorporated in Saint Lucia (hereinafter referred to as the "Broker"). We have been instructed to advise on the possibility of the Broker carrying on the services in the international forex (hereinafter referred to as the "FX”) and contract for differences (hereinafter referred to as the "CFDs”) market to retail and corporate clients (hereinafter referred to as the "Services") in accordance with the laws of Saint Lucia.

During the preparation of this Opinion, we have done a comprehensive analysis of the information and documents provided by the Broker, his working mechanism, as well as the current legislation applicable in Saint Lucia. We have prepared answers to the following questions set by the Broker:

1. How is the sphere of the Financial Services regulated on the territory of Saint Lucia?

2. Does Broker’s activity require a license in accordance with the laws of Saint Lucia?

Information and documents provided by the client for the purpose of legal analysis

In accordance with the provided information, the Broker is a company registered in Saint Lucia with the following registered address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia.

At the present time, the Broker acts as a FX and CFD broker in the international foreign exchange and contract for difference market, providing brokerage services to clients as well as trading platform and tools, accessible through website or through download, for trading in financial instruments such as FX, metals and commodities, indexes, crypto currencies in the form of spot or CFDs, by retail, corporate or institutional clients.

The Broker follows international standards of KYC and AML policies, risk disclosure, and these policies are accessible on the Broker website.

Access to the Broker's Website and services is public, therefore any individuals or legal entities can use the Broker's services (except for stateless persons; individuals under the age of 18; as well as citizens and legal entities from countries in which the Broker does not provide Services, as well as individuals or entities from a sanctioned country). However, in order to use the broker’s services the person should reach the age of majority and has full legal capacity, which such person declares by accepting the Client Agreement.

At the present time, the Broker acts as a FX and CFD broker in the international foreign exchange and contract for difference market, providing brokerage services to clients as well as trading platform and tools, accessible through website or through download, for trading in financial instruments such as FX, metals and commodities, indexes, crypto currencies in the form of spot or CFDs, by retail, corporate or institutional clients.

The Broker follows international standards of KYC and AML policies, risk disclosure, and these policies are accessible on the Broker website.

Access to the Broker's Website and services is public, therefore any individuals or legal entities can use the Broker's services (except for stateless persons; individuals under the age of 18; as well as citizens and legal entities from countries in which the Broker does not provide Services, as well as individuals or entities from a sanctioned country). However, in order to use the broker’s services the person should reach the age of majority and has full legal capacity, which such person declares by accepting the Client Agreement.

The law

1. How is the sphere of the Financial Services regulated on the territory of Saint Lucia?

1.1. Organizational and legal form of the Broker's company

The Broker's company is incorporated in accordance with the International Business Company's Act Cap 12.14 (IBC Act) with the organizational and legal form - a limited liability company as international business companies (hereinafter referred to as “IBC”). The relevant law is contained in the Registered Agents and Trustee's Licensing Act Cap 12.12 (RATLA). IBCs are entitled to engage in any commercial activity, as long as it is legal, without additional approval / licensing from the Financial Services Regulatory Authority (https://fsrastlucia.org/index.php/about-us) (FSRA).

1.2. Restrictions for IBC

In accordance with section 12 (1) IBC ACT 12.14, IBC cannot engage in insurance or banking activities, as well as carry out the activities of a mutual investment fund. IBCs cannot raise money from residents of Saint Lucia and offer to publicly sell shares in the company. The law outlinesthe prohibited business activities both in the International Business Companies Act and within the Registered Agent and Trustees Licensing act (Section 12 (1) (g)). From the mentioned legislation we can find out what businesses are prohibited and which are permitted under law applicable in St. Lucia. IBC cannot engage in any activity for which a license issued by the FSRA is required, including mutual funds, international banking business, the international insurance business, international financial services representation. All other business activities are permitted, if the IBC would carry out business externally from Saint Lucia.

2. Does Brokerage activity require a license in accordance with the laws of Saint Lucia?

2.1. Financial regulator in the region

Until the legislation governing activities in the FX and CFDs market is adopted, there is no legal prohibition against IBC engaging in such activities or declaring it in its Articles of Association. The trading of securities or the carrying on of a foreign exchange business is not defined by either the IBC act, RATLA or Money Services Business Act Cap 12.22 of Saint Lucia. Therefore, the carrying on of a foreign exchange business is not a prohibited activity under either the IBC Act or other legislation applicable in St. Lucia and an IBC can engage in any of these business activities.

2.2. Availability/absence of a license

Having analyzed the legislation that is in force in Saint Lucia, as well as official information from the FSRA, one can come to a definite conclusion that a license for the Services in the FX and CFDs markets is not required and not applicable by the FSRA.

1.1. Organizational and legal form of the Broker's company

The Broker's company is incorporated in accordance with the International Business Company's Act Cap 12.14 (IBC Act) with the organizational and legal form - a limited liability company as international business companies (hereinafter referred to as “IBC”). The relevant law is contained in the Registered Agents and Trustee's Licensing Act Cap 12.12 (RATLA). IBCs are entitled to engage in any commercial activity, as long as it is legal, without additional approval / licensing from the Financial Services Regulatory Authority (https://fsrastlucia.org/index.php/about-us) (FSRA).

1.2. Restrictions for IBC

In accordance with section 12 (1) IBC ACT 12.14, IBC cannot engage in insurance or banking activities, as well as carry out the activities of a mutual investment fund. IBCs cannot raise money from residents of Saint Lucia and offer to publicly sell shares in the company. The law outlinesthe prohibited business activities both in the International Business Companies Act and within the Registered Agent and Trustees Licensing act (Section 12 (1) (g)). From the mentioned legislation we can find out what businesses are prohibited and which are permitted under law applicable in St. Lucia. IBC cannot engage in any activity for which a license issued by the FSRA is required, including mutual funds, international banking business, the international insurance business, international financial services representation. All other business activities are permitted, if the IBC would carry out business externally from Saint Lucia.

2. Does Brokerage activity require a license in accordance with the laws of Saint Lucia?

2.1. Financial regulator in the region

Until the legislation governing activities in the FX and CFDs market is adopted, there is no legal prohibition against IBC engaging in such activities or declaring it in its Articles of Association. The trading of securities or the carrying on of a foreign exchange business is not defined by either the IBC act, RATLA or Money Services Business Act Cap 12.22 of Saint Lucia. Therefore, the carrying on of a foreign exchange business is not a prohibited activity under either the IBC Act or other legislation applicable in St. Lucia and an IBC can engage in any of these business activities.

2.2. Availability/absence of a license

Having analyzed the legislation that is in force in Saint Lucia, as well as official information from the FSRA, one can come to a definite conclusion that a license for the Services in the FX and CFDs markets is not required and not applicable by the FSRA.

Conclusions

Our conclusions and expert opinion are valid as of the date this document is signed. Since later changes in legislation may occur, this may affect the views expressed in it. We do not undertake any obligation to inform you or any other party wishing to rely on this opinion of any such changes, material or immaterial, or of any other matter that may be brought to our attention in the future.

Based on the results of our analysis of the information, and documents provided by the Broker, as well as taking into account the provisions of the current legislation of Saint Lucia, the position of the FSRA and the established business practice in the considered sphere of legal relations, the following conclusions can be drawn: In providing its Services, the Broker is an IBC under the applicable laws of Saint Lucia and is not regulated by the FSRA.

A license for the Services on the FX and CFDs market is not required by the FSRA. At the present time, there are no legal prohibitions for the Broker to provide Services, conduct mutual settlements with its clients/partners, or declare this publicly, including for marketing and/or advertising purposes, nor any restrictions for the Broker to solicit clients in other countries around the world.

Based on the results of our analysis of the information, and documents provided by the Broker, as well as taking into account the provisions of the current legislation of Saint Lucia, the position of the FSRA and the established business practice in the considered sphere of legal relations, the following conclusions can be drawn: In providing its Services, the Broker is an IBC under the applicable laws of Saint Lucia and is not regulated by the FSRA.

A license for the Services on the FX and CFDs market is not required by the FSRA. At the present time, there are no legal prohibitions for the Broker to provide Services, conduct mutual settlements with its clients/partners, or declare this publicly, including for marketing and/or advertising purposes, nor any restrictions for the Broker to solicit clients in other countries around the world.

Ground Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O. Box 838, Castries, Saint Lucia Tel. +44 07527089165 (London) or +1 758 285 7447 (St. Lucia).

10th October, 2024

PER TONJAKA E. HINKSON (ATTORNEY AT LAW PARTNER STERLING LEGAL LTD.)

Certificate